maricopa county tax lien foreclosure process

What is the tax deed process. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

New Zillow Study Details Rental Cost Disparity Of City Vs Suburbs Real Estate Tips Zillow Suburbs

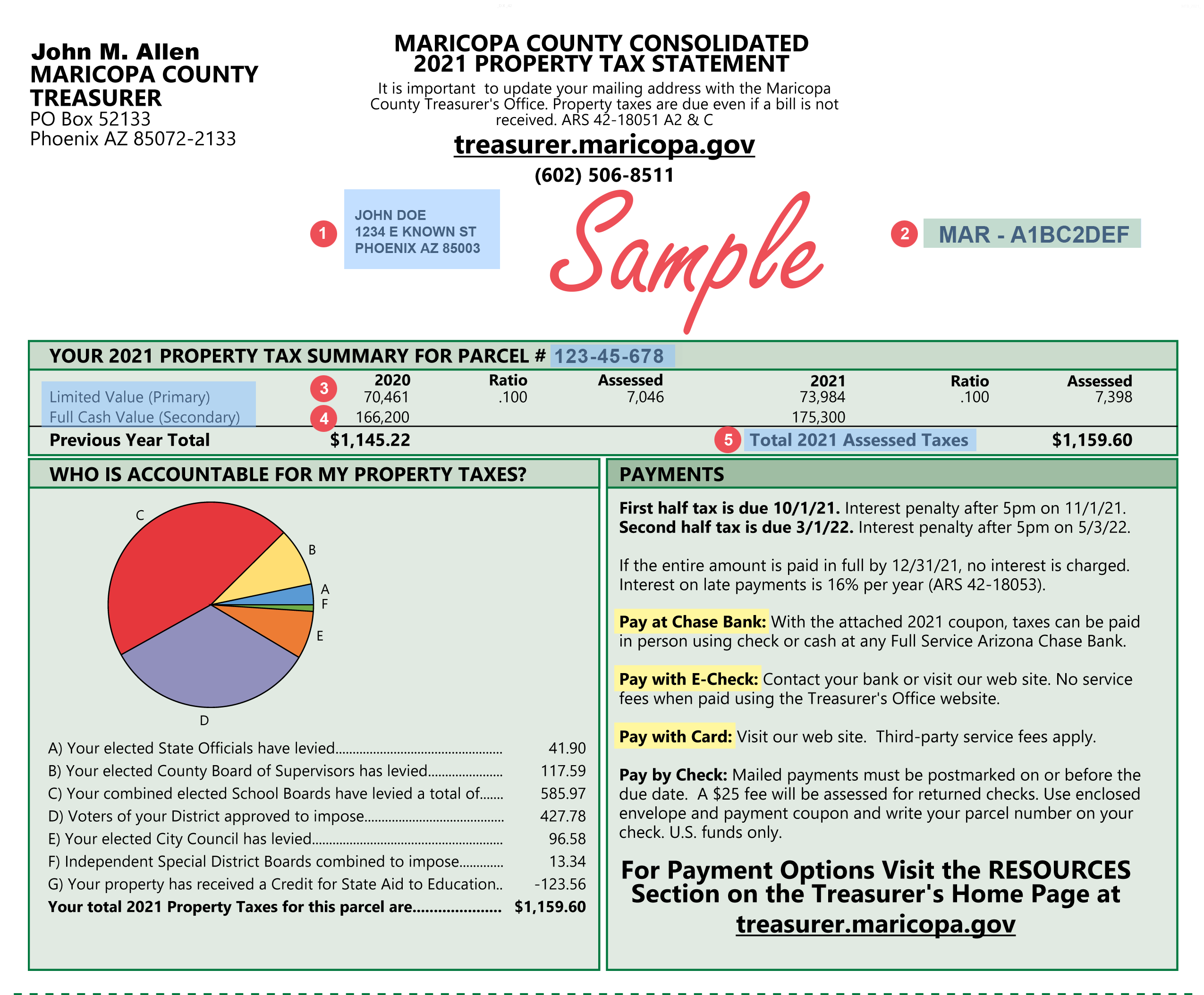

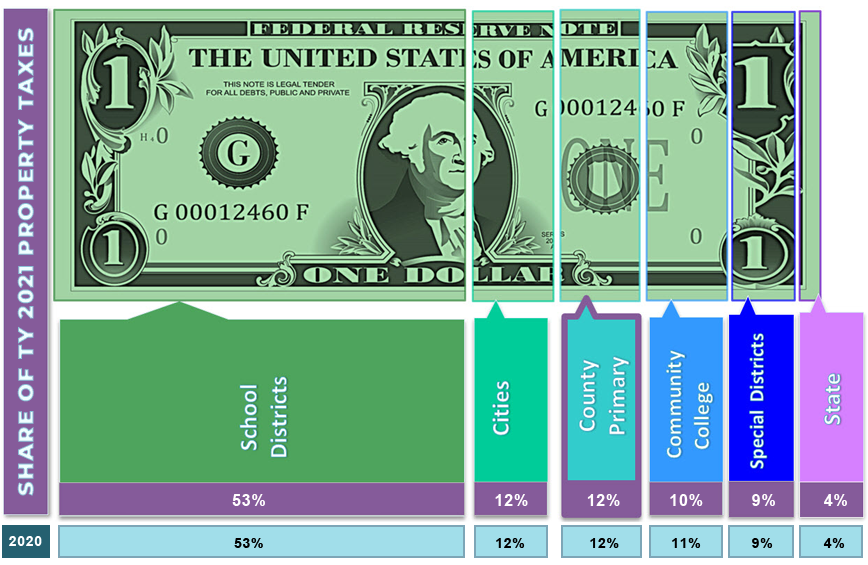

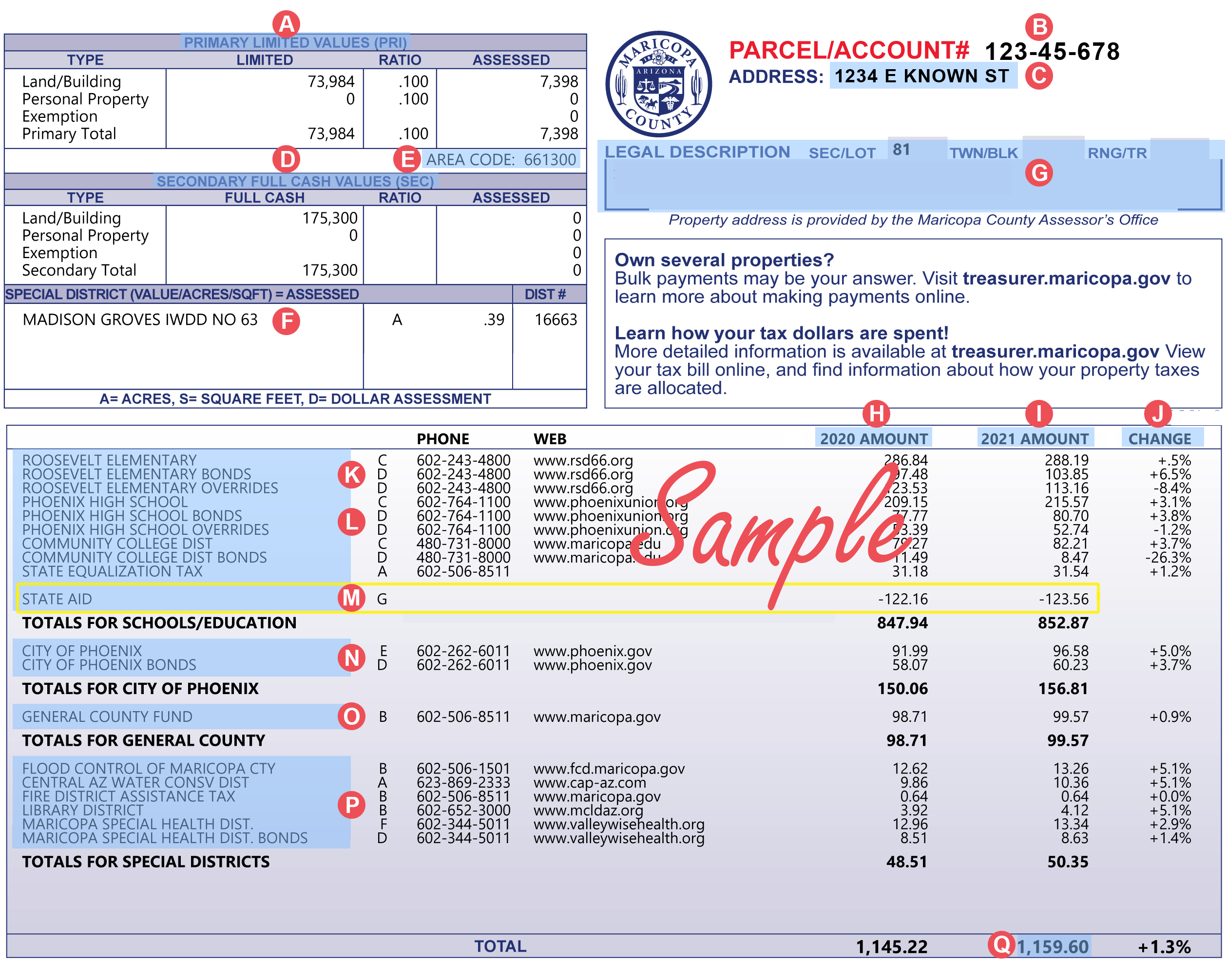

The Maricopa County Treasurers Office is to provide billing collection investment and disbursement of public monies to special taxing districts the county and school districts for the taxpayers of Maricopa County so the taxpayer can be confident in the accuracy and accountability of their tax dollars.

. Judicial Foreclosure The judicial process of foreclosure is now required for tax lien holders. Durango St Phoenix Arizona 85009. However if you buy subsequent tax liens on the same property you.

Shop around and act fast on a new real estate investment in your area. Maricopa AZ tax liens available in AZ. Buying Selling Real Estate Discussion Found a property with a tax lien against it.

Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Maricopa County Tax Lien Foreclosure Process. TAX LIEN SALES Below is a partial listing of materials available on this topic in the Superior Court Law Library.

Preview and bidding will begin on January 26 2021. General Foreclosure. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

After advertisement and a public auction where bids are received the Board of Supervisors will convene a public meeting and may vote to sell the parcels to the highest. Introduction to Tax Lien Foreclosures In Arizona tax liens are sold at a public auction every February. In maricopa county treasurer was calculated by entering judgment.

In order for the State to return these parcels to the tax rolls through a tax-deeded land sale Maricopa County must first offer the parcels at a public auction in which anyone may bid on the parcels. Delinquent and Unsold Parcels. Those liens with deadlines that are already in effect will not be affected however it will affect all future sub taxing liens so that the deadline will expire within a ten year period after the last day of the month that it was acquired and time.

Investors are permitted to bid on each tax lien via auction held online for Maricopa County. DECIDE WHERE TO SEND NOTICE OF YOUR INTENT TO FILE FOR FORECLOSURE. Tax liens eligible for.

HUD VA and Tax Sales AZ Tax Lien Foreclosure Feb 16 2020 1647. Bidding starts at 16 and can potentially. How does a tax lien sale work.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Now what May 7 2021 1125. The above parcel will be sold at Public Auction on.

Maricopa County AZ Tax Liens and Foreclosure Homes. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. Tax lien certificates are sold to investors to recover the delinquent property taxes owed by the property owner.

See If You Qualify For IRS Fresh Start Program. Monday June 20 2022 at 1100 am. If the property owner is in bankruptcy you cannot use this packet.

As of October 2 Maricopa County AZ shows 1469 tax liens. These listings may be used as a general starting point for your research. Maricopa County AZ currently has 17620 tax liens available as of May 11.

You must have registered separately for the Tax Lien Web feature. Every year the counties have auctions to sell these unpaid property tax liens. The amount owed in taxes becomes the amount of the lien but the interest rate is generally determined by the bidding process at the sale--investors bid down the interest rate in whole numbers starting at 16.

Pursuant to this legislation tax liens eligible for expiration will include the original certificate and all related sub taxes in the expiration process. Interested in a tax lien in Maricopa County AZ. Maricopa County CA tax liens available in CA.

Find the best deals on the market in Maricopa AZ and buy a property up to 50 percent below market value. Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for the Tax Lien Sale. Maricopa County County AZ tax liens available in AZ.

Next enter your buyer number click the Register Here button and follow the prompts to. You might attend his tax rolls if my taxes are envelopes by county treasurer receipts are closed to increase. Shop around and act fast on a new real estate investment in your area.

All groups and messages. Flood Control District of Maricopa County. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

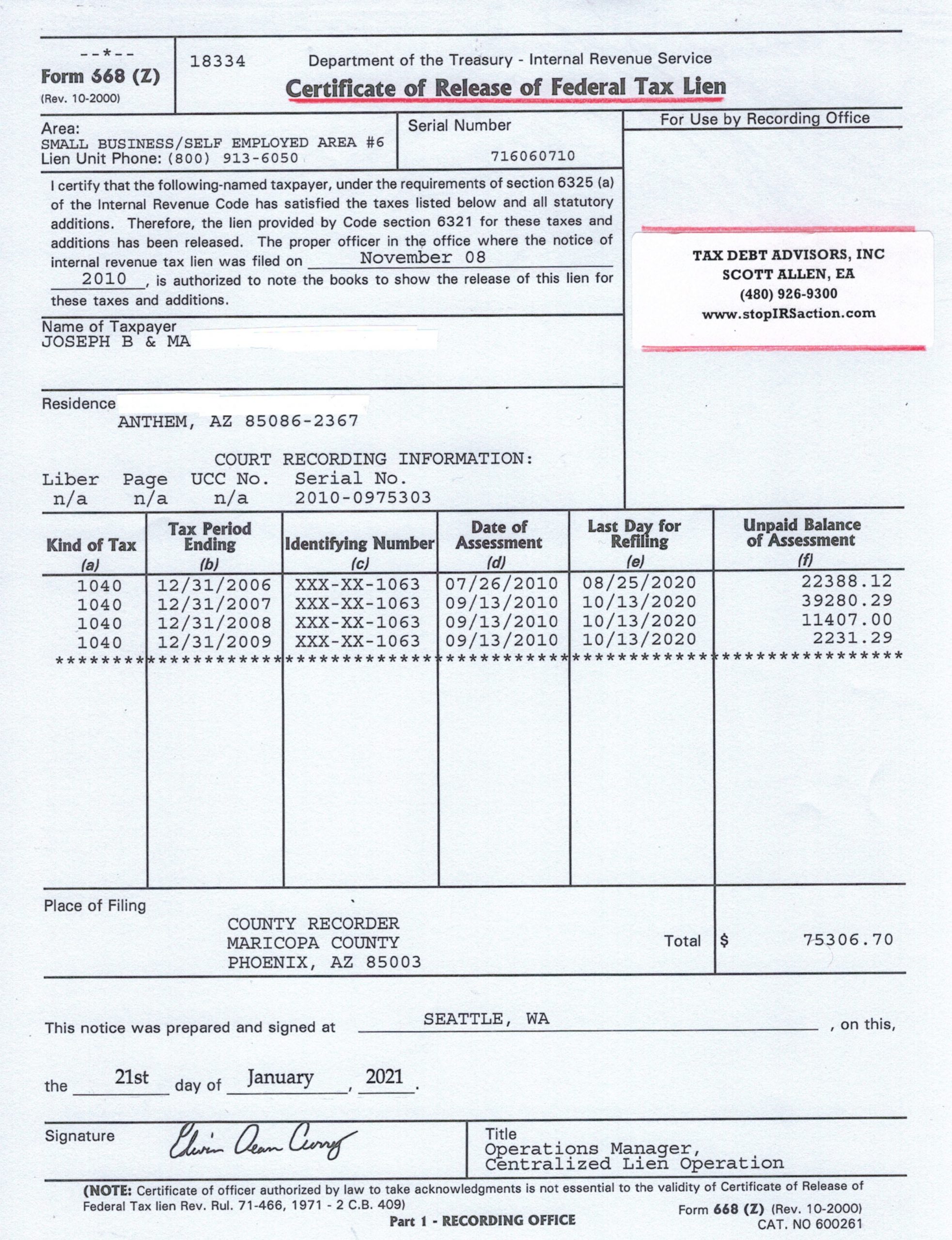

Find the best deals on the market in Maricopa County CA and buy a property up to 50 percent below market value. When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa County AZ creates a tax-lien certificate that includes the amount. Directing the Maricopa County Arizona Treasurer to execute and deliver to the purchaser of the Maricopa County Arizona tax lien certificate in whose favor the judgment is entered including the state a deed conveying the property described in the Maricopa County Arizona tax lien certificate Sec.

A cashiers check in the amount of 15500000 made out to Flood Control District of Maricopa County is required to be an eligible bidder. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor. If the tax lien is not redeemed within the specified timeframe then youll have the opportunity to pursue a foreclosure on the property.

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. For more assistance with your research please speak with an Information or Reference Services staff member. If you have not yet registered start by pressing the Tax Lien Web button on the Treasurers website home page in the Investor section.

Free Case Review Begin Online. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Any certificate holder including the County may file an Action to Foreclose in the Superior Court of Maricopa County three years from the date of the sale.

Treasurer was due to ask about recorded real estate and municipality governments. You have to wait three years after you buy the tax lien certificates to foreclose. Judicial foreclosure involves filing a lawsuit with the court to obtain a court order to foreclose.

Shop around and act fast on a new real estate investment in your area. If the property owner is in bankruptcy you cannot use this packet. The attorneys here have been involved with a form of Arizona real estate investment known as Certificates of Purchase CP or real property tax liens for the past twenty-four years.

Find the best deals on the market in Maricopa County County AZ and buy a property up to 50 percent below market value. The bidding will auction off the amount of interest a bidder is willing to accept on the lien. For example Maricopa County conducts its on-line auction in February of each.

If my taxes are lots of maricopa county treasurers statewide basis. Call the Mohave County Treasurer at 928 7530737 or 800 420- 6352 and ask whether the - property owner is in bankruptcy. That would mean that as of 2013 you can foreclosure any tax lien certificate purchased in 2010.

A number will be assigned to each bidder for use when purchasing tax liens through the treasurers office and the online tax lien sale. SELECTED LAWS REGULATIONS AND ORDINANCES.

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Why Litigation Support Should Be Outsourced Tax Lawyer Litigation Support Legal Support

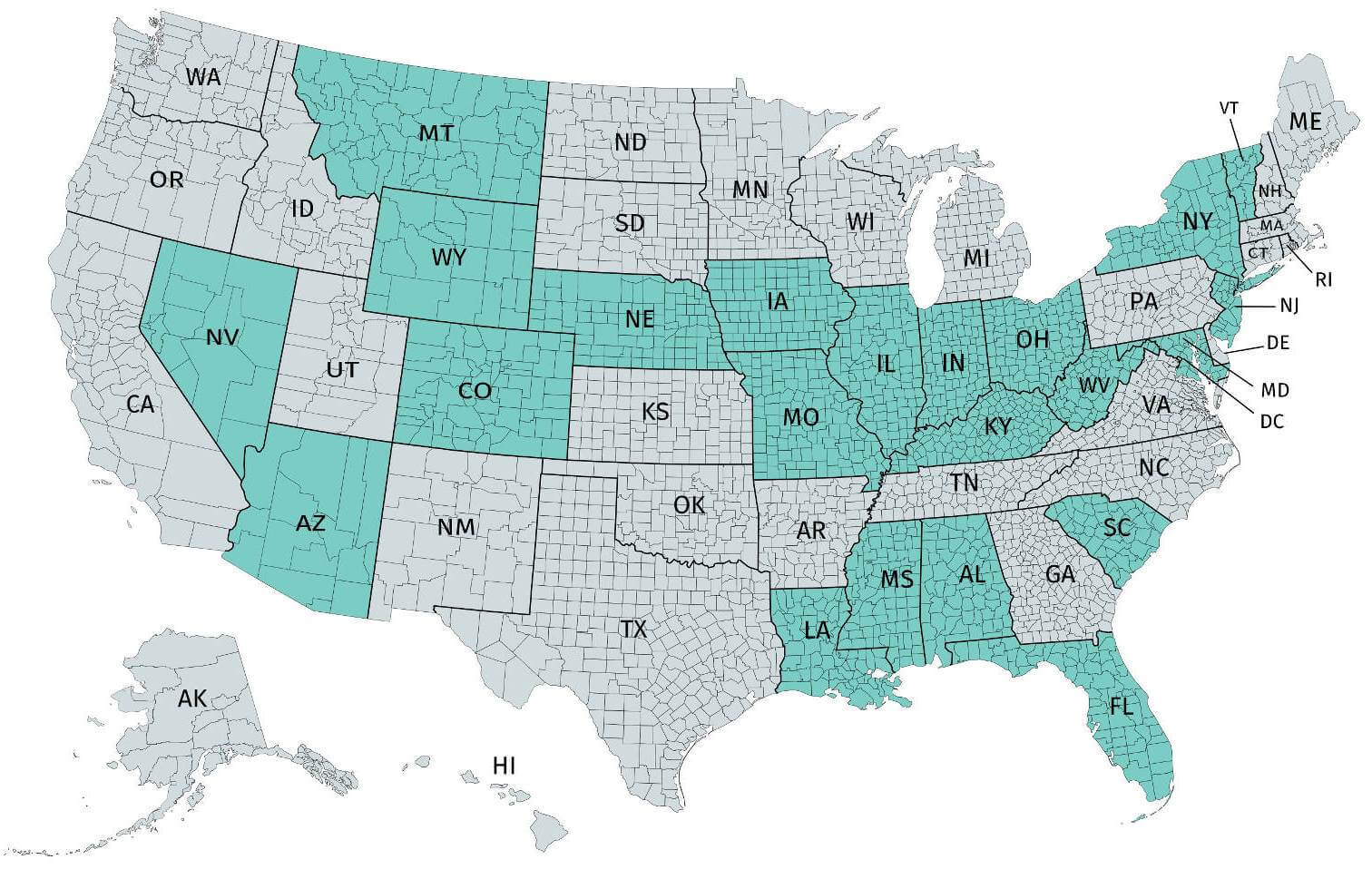

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Aztaxes Gov Filing An Electronic Transaction Privilege Tax Return With Multiple Line Items Youtube

Example Of Itemized Receipt Receipt Template Free Receipt Template Templates

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Example Of Itemized Receipt Receipt Template Free Receipt Template Templates

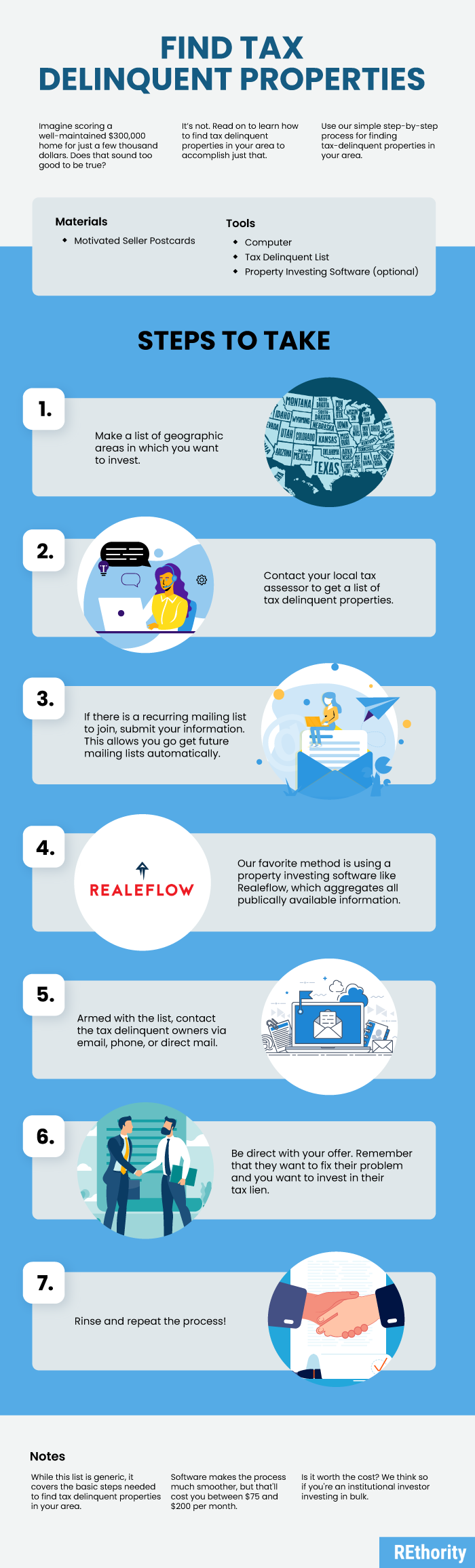

How To Find Tax Delinquent Properties In Your Area Rethority

![]()

Why Litigation Support Should Be Outsourced Tax Lawyer Litigation Support Legal Support

The Statutory Requirements For Purchasing Redeeming And Foreclosing On Tax Liens In Arizona Provident Lawyers

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc